Firsthand Technology Opportunities Fund

| Average Annual Total Returns vs. Indices | |||

|---|---|---|---|

| As of SEPTEMBER 30, 2025 | |||

| Period | Firsthand Technology Opportunities Fund |

NASDAQ Composite Index | S&P 500 Index |

| Since inception (9/30/99) | 1.94% | 9.48% | 8.54% |

| 10-Year | 6.27% | 18.32% | 15.30% |

| 5-Year | -10.83% | 16.07% | 16.47% |

| 3-Year | 1.09% | 29.92% | 24.94% |

| 1-Year | 44.88% | 25.42% | 17.60% |

| Q3 '25 (not annualized) | 8.96% | 11.41% | 8.12% |

| Monthly Performance Update | |||

|---|---|---|---|

| As of October 31, 2025 | |||

| Period | Firsthand Technology Opportunities Fund |

||

| Since inception (9/30/99) | 2.16% | ||

| 10-Year | 6.37% | ||

| 5-Year | -10.23% | ||

| 3-Year | 4.17% | ||

| 1-Year | 55.62% | ||

| 1-Month | 5.93% | ||

The Fund's performance information assumes reinvestment of all dividends and includes all Fund expenses, but does not reflect the impact of taxes. Performance data quoted represent past performance, which is not a guarantee of future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Fund will fluctuate so that any investor's shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

The Fund's total gross operating expenses are 1.87%. The Fund's total net operating expenses are 1.85%. Under the Investment Advisory Agreements, the Investment Adviser has agreed to reduce its fees and/or make expense reimbursements so that the Fund's total operating expenses (excluding independent trustees' compensation, brokerage and commission expenses, litigation costs and any extraordinary and non-recurring expenses) are limited to 1.85% of the Fund's average daily net assets up to $200 million, 1.80% of such assets from $200 million to $500 million, 1.75% of such assets from $500 million to $1 billion, and 1.70% of such assets in excess of $1 billion. The current expense waiver is in effect until 4/30/26.

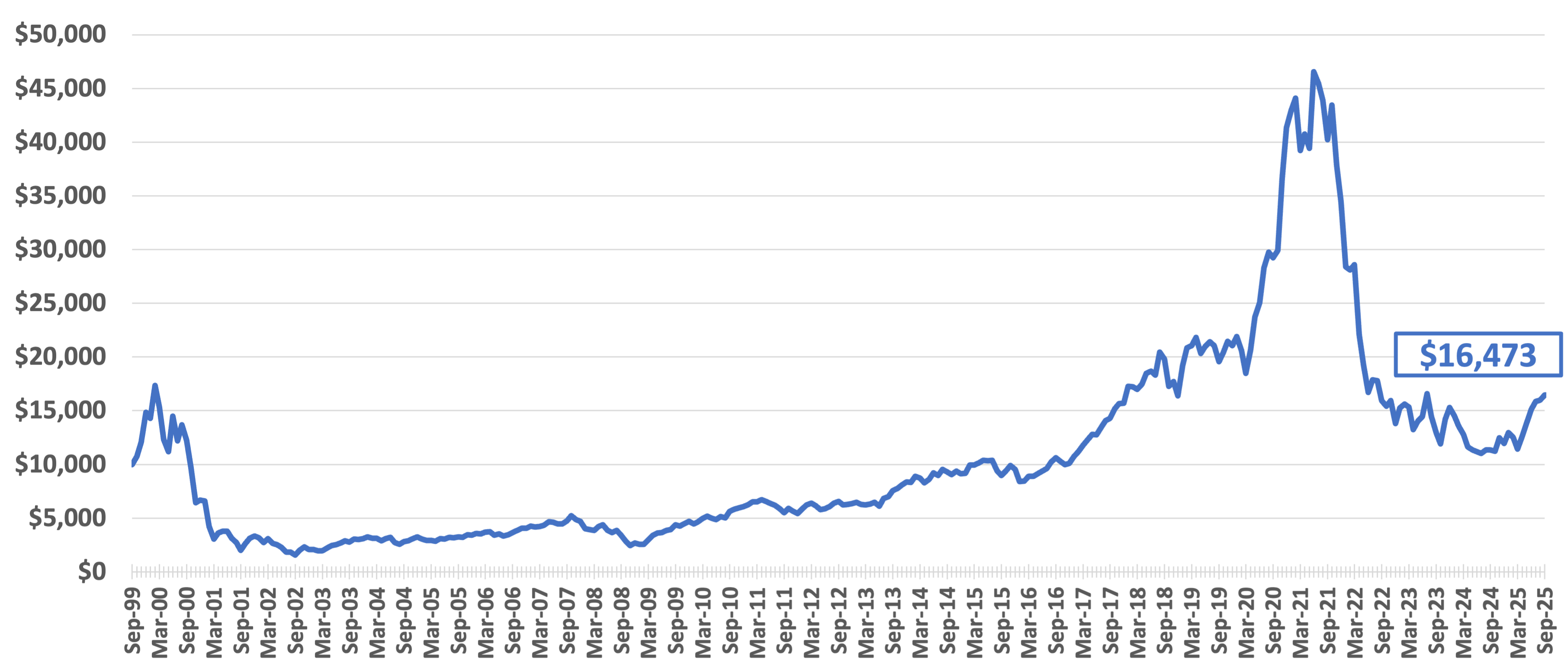

Growth of a Hypothetical $10,000 Investment

September 30, 1999 through September 30, 2025

Chart represents the growth of a hypothetical $10,000 investment from Firsthand Technology Opportunities Fund inception date until the end of the quarter indicated. Firsthand Technology Opportunities Fund performance assumes reinvestment of all dividends and includes all Firsthand Technology Opportunities Fund expenses but does not reflect the impact of taxes.

Q3'25 Contributors to Performance

Data analytics software supplier Palantir (PLTR) was the biggest contributor to the Fund’s performance in Q3. The company announced in August that quarterly revenues exceeded $1 billion for the first time in its quarter ended June 30, 2025. Palantir also raised its guidance for full-year 2025 revenues. The company’s stock was up approximately 34% during Q3.

The second largest contributor to fund performance in Q3 was Oklo (OKLO). The nuclear energy company’s stock was up more than 50% in September, benefitting from renewed U.S. government support for nuclear power initiatives. Oklo also celebrated the groundbreaking for its first Aurora powerhouse at Idaho National Laboratory in September.

Roku (ROKU) was the third most significant positive contributor to fund performance in Q3. The internet streaming leader announced revenues and earnings for its fiscal second quarter that exceeded analysts’ expectations. The company’s stock slumped following the earnings announcement, however, as declining gross margins in its platform business weighed on investor sentiment. After a subsequent rebound, Roku stock finished the quarter up 13.9%.

Q3'25 Detractors from Performance

The largest detractor from the Fund’s performance in Q3 was video streaming giant Netflix (NFLX). Despite Q2 revenues and earnings that beat Wall Street expectations, Netflix stock fell sharply in the second half of the month as the company’s revenue outlook disappointed investors. Netflix stock was down 10.5% in Q3.

Workflow management software developer monday.com (MNDY) was the second-largest detractor from fund performance in Q3. The company exceeded expectations with its second-quarter revenues and earnings, but its forward-looking guidance for Q3 and the full year reflected slowing growth and slimmer margins. The Fund liquidated its position in monday.com shortly thereafter.

Restaurant management software company Toast (TOST) was the third largest detractor from the Fund’s performance in Q3. Toast’s stock reached a high for the year on August 1 before giving up some of its year-to-date gains after its second quarter earnings announcement on August 5. The company’s shares finished the quarter down 17.6% but remained up marginally on a year-to-date basis.

Firsthand Technology Opportunities Fund is subject to greater risk than more diversified funds because of its investments in fewer securities and because of its concentration of investments in certain industries in the technology sector. Specific risks associated with investments in the technology industries (as described in the Fund's Prospectus) could cause the Fund's share price to fluctuate dramatically. The Fund's investments in small-cap companies present greater risk than investments in larger companies. The Fund invests in several industries within the technology sector and the relative weightings of these industries in the Fund's portfolio may change at any time. Equity investing involves risks, including the potential loss of the principal amount invested.

The NASDAQ Composite Index (NASDAQ) and the Standard & Poor's 500 Index (S&P 500) each represent an unmanaged, broad-based basket of stocks and are typically used as benchmarks for overall market performance. The indices' performance figures assume the reinvestment of all dividends (except where noted), but do not reflect the impact of taxes. Additionally, because an investor cannot invest in an index directly, indices' performance figures do not reflect the expenses associated with the management of an actual mutual fund portfolio.

As of 9/30/25: PLTR (12.1% of TEFQX), OKLO (4.1% of TEFQX), ROKU (13.8% of TEFQX), NFLX (9.9% of TEFQX), MNDY (0.0% of TEFQX), TOST (4.0% of TEFQX). A complete list of portfolio holdings for Firsthand Funds is available on www.firsthandfunds.com and is updated 45 days after the end of every calendar quarter. The portfolio holdings discussed are subject to change.

The information provided should not be considered a recommendation to purchase or sell a particular security and there is no assurance that, as of the date of publication, the securities purchased remain in a Fund's portfolio or that securities sold have not been repurchased. Also, you should note that the securities discussed, even if they have been purchased by a Fund, do not represent a Fund's entire portfolio and, in the aggregate, may represent only a small percentage of that Fund's holdings. There can be no assurance that any Firsthand Funds will buy, sell, or hold any particular security after the date referred to in the discussion.